An institutional partner to the cannabis industry

Fueling the growth of businesses and management teams

About Us

We leverage a decade of hands-on experience in the cannabis industry and nearly half a century of combined institutional investing experience to help businesses capitalize on their growth potential. Our investment philosophy is straightforward: within an extremely complex industry, we seek to fund simple and proven business models that are run by best-in-class entrepreneurs. This enables us to maximize risk-adjusted returns while providing management with the trust, freedom and insight to effectively run their companies.

Value Proposition

Investors

Track Record

Prior to the founding of FocusGrowth, we made and exited a number of successful credit and private equity investments in the cannabis space. Since then, we have deployed approximately $484 million of capital in the cannabis industry.¹

Led or co-led 15 of the 21 deals we have been involved in.

Evaluated deals in almost every legal cannabis market in the U.S.

Robust Pipeline

As of Q4 2023, we have a robust and actionable $500 million pipeline across 25 states.

Flexible Mandate

We strive to invest in growth companies, targeting an asymmetric risk/reward dynamic. We believe our flexible investment mandate with regard to structure and forms of return allows FocusGrowth to provide investors with an optimized risk adjusted return.

Institutional Caliber Leadership

We believe we have deep knowledge of credit and private equity investing, working with some of the world’s most prominent financial institutions.

Partners

Relatable & Relevant Experience

FocusGrowth differentiates itself through its team — former cannabis industry operators and veteran institutional investors. We collectively have a decade of hands-on experience in the cannabis industry and understand what it is like to execute on and grow your business model in the complex world that is the legal cannabis industry.

Long Term Capital Partners

We invest in our partners for the long term through fully committed private equity vehicles to ensure that we are around for years of growth to come.

Deep Industry Networks

Through our years of professional experience we believe we have cultivated an unrivaled network of operators, investors, and service providers that often aide our portfolio companies in their myriad needs.

Efficient Underwriting

Through the team's previous operational experience, we have worked alongside a wide and dynamic swath of the legal cannabis industry. We believe this has enabled the development of unparalleled and efficient underwriting and portfolio monitoring processes.

Legal and Regulatory Expertise

Cannabis is complex and evolving. We possess a comprehensive understanding of the industry's mosaic of laws and regulations that allow us to mitigate downside and unlock value for investors and portfolio companies alike.

¹ As of Q4 2023. $484M of capital deployed includes the total of (i) capital invested in portfolio companies by FocusGrowth, (ii) recycled capital and refinancing activities, and (iii) third-party capital not managed by FocusGrowth but deployed alongside our investment in deals where FocusGrowth was the lead or co-lead investor. Includes face value of debt investments and funded value of equity investments. FocusGrowth is not responsible for any investment decision making activities relating to the third-party capital, which is managed independently of the firm and comprises approximately $97M of the capital deployed figure above. Such assets are not included within our regulatory assets under management.

The Opportunity²

Our Portfolio

We have a presence across the United States with representation in many legal cannabis markets. Our growing presence in the industry is reflected by our $500 million pipeline of deals across 25 states.

$500 Million

Potential Deal Value in Current Pipeline

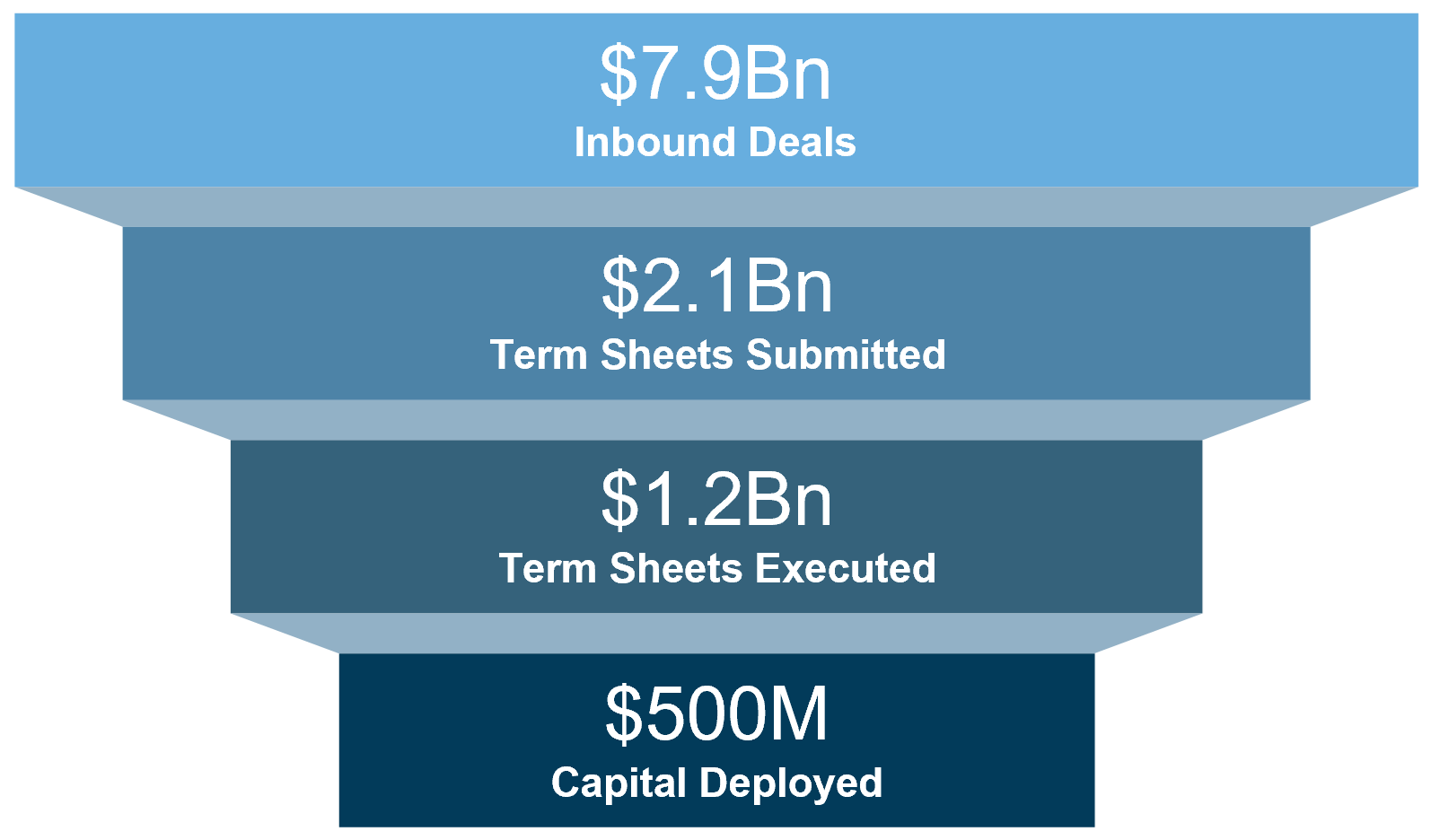

FocusGrowth takes a disciplined approach to deal selection…

…With a portfolio curated toward market leaders in highly regulated jurisdictions

² As of Q4 2023. $484M of capital deployed includes the total of (i) capital invested in portfolio companies by FocusGrowth, (ii) recycled capital and refinancing activities, and (iii) third-party capital not managed by FocusGrowth but deployed alongside our investment in deals where FocusGrowth was the lead or co-lead investor. Includes face value of debt investments and funded value of equity investments. FocusGrowth is not responsible for any investment decision making activities relating to the third-party capital, which is managed independently of the firm and comprises approximately $97M of the capital deployed figure above. Such assets are not included within our regulatory assets under management.

Market Potential

The market for both medical and recreational legal cannabis sales has grown every year since its introduction. In the next five years, industry revenue is expected to exceed $50 billion, 10x the levels seen in 2015.

Investment Strategy

Exclusively focused on brick-and-mortar businesses in the legal cannabis industry

Proprietary sourcing channels and networks built through nearly a decade of industry experience

Primarily targeting loans that are secured by first liens on real estate, licenses, and equipment

Holistic approach to valuation and loan coverage analysis through cash flow as well as hard assets

Boots-on-the-ground due diligence process focuses on real industry channel checks into the asset fundamentals, management teams, and regulatory regime

Our Team

A decade of collective years working together through credit investing and cannabis operations.

CEO

Investment Team

Investment Team

Investment Team

Associate

Investment Team

Investment Team

Operations Team

Operations Team

Operations Team

Our Team

A decade of collective years working together through credit investing and cannabis operations.

In the News

VANCOUVER, BC, July 20, 2021 /PRNewswire/ - Body and Mind Inc. (CSE: BAMM) ( OTCQB: BMMJ) (the "Company" or "BaM"), a multi-state operator, is pleased to announce that it has closed a US$11.1 million debt financing (the "Loan") with related entities to FocusGrowth Asset Management, LP (collectively, "FGAM").

Jul 20, 2021

Contact

FocusGrowth Asset Management

NY Office

747 Third Avenue, Suite 3602

New York, NY 10017

PA Office

3477 Corporate Parkway, Suite 102

Center Valley, PA 18034